Economic Adviser Dr. Steven Skancke Looks at Impact of Skyrocketing US DebtÂ

Read Transcript

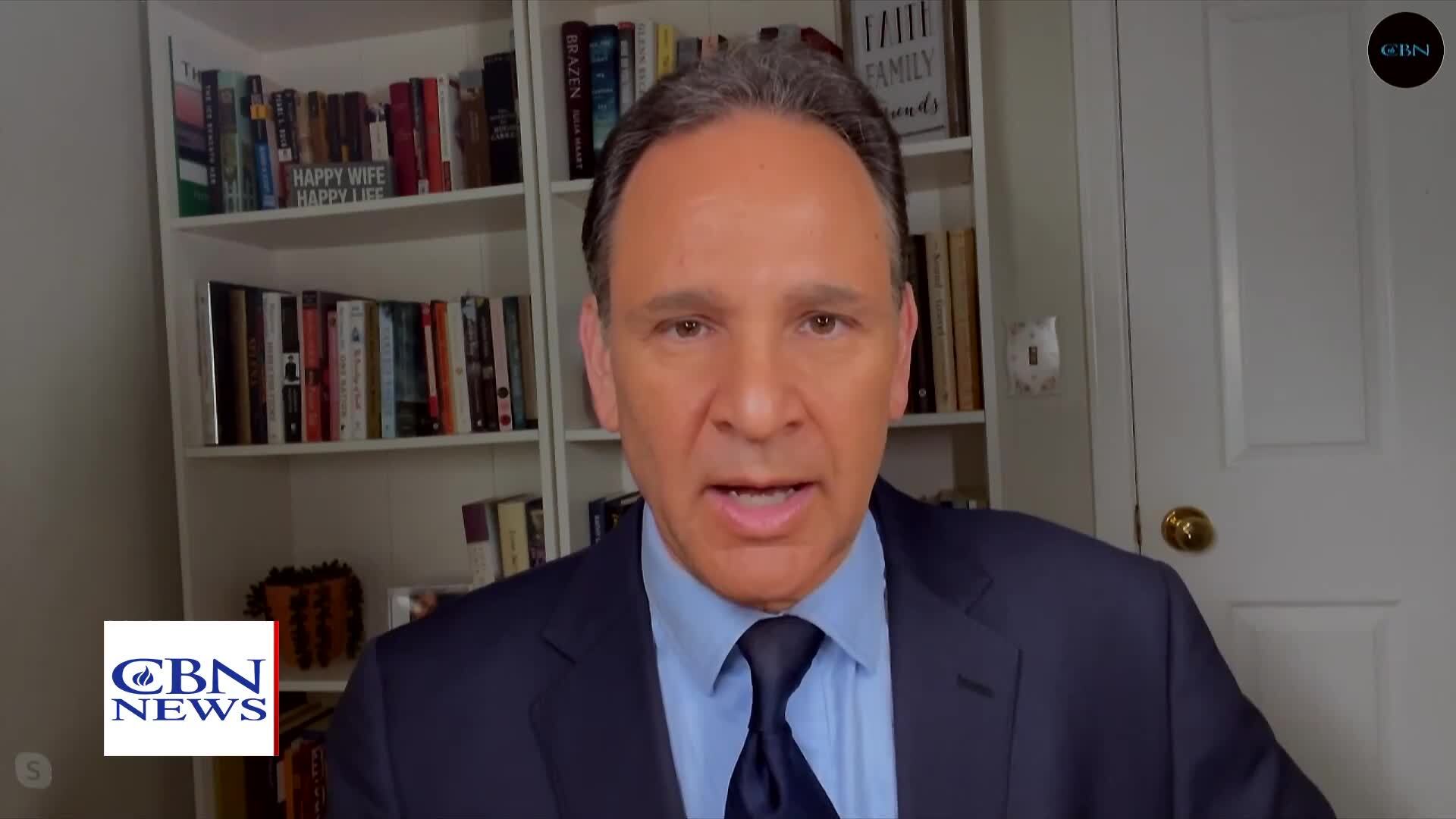

- And with us now totalk more about the debt

and the economy is Dr. Steven Skancke.

He is the Chief Economic Advisor

and the Wealth Management and Invest,

Wealth Management andInvestment Firm, Keel Point.

And he's also a formerstaffer in the Nixon-Ford,

Carter, Reagan, andReagan administrations.

So we appreciate you being with us.

How will all this debt affectour current economic recovery?

- Well, it's actually a positive for the

current economic recovery

because what's needed mostwhen the private sector

is lagging, is for fiscal stimulus

supported by monetary stimulus,

and that certainly is what thefederal government is doing.

The Congressional Budge Office estimates

are for 3.3 trillion deficit which is

an addition to the federaldebt by the end of September,

and other estimates show that by the end

of the calendar year, therewill be another 1.2 trillion

added to, or in federal deficitadded to the federal debt.

But right now, it's a boost that helps

keep the economy recovering, and certainly

keeps stocks markets soaring.

- What is the longer term impact?

All these numbers overwhelmingto many people hearing them.

What's the longer term impact?

- Well, the longer termimpact is that it tends

to impede economic growth.

The expected rate ofannual economic growth

will just be less as aresult of this debt overhang

that has to be dealt with.

It becomes part of the federal budget

because you have to payinterest on the debt,

and although interest ratesare very low right now,

that isn't always the case, as we know.

And it diverts resourcesfrom other productive use.

The large debt also can contributeto inflationary pressures

and inflationary expectations, over time.

When we get out of the economic recession

that we're in, and we reachfull employment again,

and the economy is doing quite well,

that's just part of howthat equation works.

- So doctor, the stock market

has been hitting record highs.

Is Wall Street notconcerned about the various

potential problems for theeconomy, like the coronavirus,

as well as the debt?

- Well, the Wall Streetis certainly concerned

about the coronavirus, notso much about the debt.

The debt issue is reallymore of a longer term issue.

The stock market is concernedabout what's happening

in the next 12 to 18months, and right now,

their eyes are whenwill the recession end,

when will earnings recover?

And their expectation

for earnings for 2021 is forrecord corporate earnings

in 2021, and so that'spart of what's driving it.

They're paying attentionto when will a vaccine

to contain the virus be first available,

and then generallyavailable, and they're also

paying attention to what'sthe federal reserve doing,

what role are they goingto continue to play

as the economy recovers, and will there be

additional fiscal stimulus,which, by definition,

will further add to the debt.

- So is there any way that we can ever pay

this debt down?

- Well, certainly, wecan pay it down over time

but when we look back inthe history of the US,

we came out of WorldWar II with a huge debt

relative to the size of our economy,

and just through economic growth,

very robust economic growth in the 1950s,

high labor productivity that contribute

to rising standards of living

allowed the repayment of the debt.

And so the federal debtas a percentage of GDP

was very low when we came to 1960.

The policy of the government changed

beginning in '61, believingthat debt was a positive,

a more positive contributorto economic growth

and so the debt was allowed to rise.

We also saw it being paiddown in the late 1990s

when the economy was booming

and federal expenditures were curtailed.

- All right, thank you somuch, much appreciated.

We appreciate your insight, Dr. Steven.

- Great to be with you.